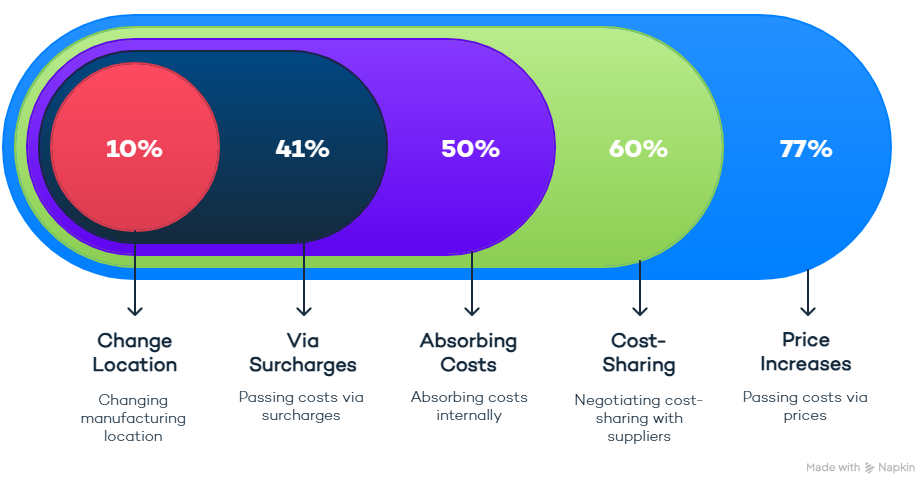

77% of manufacturers are passing tariff costs to customers—only 10% are shifting production.

Tactical Response, Not a Structural Shift

Most companies are employing tactical measures to mitigate tariff costs. Results from the June Mid-Year Tariff Impact survey indicate the most common approach (77%) is passing costs to customers via price increases. Other strategies include negotiating cost-sharing with suppliers (60%) and absorbing costs internally (50%). Surcharges are also being used by 41% of respondents. Structural changes, such as relocating manufacturing operations, remain less common, with only 10% undertaking such a shift.

Company Responses to Increased Costs

Source: Manufacturers Alliance Mid-Year Tariff Impact Survey, June 2025

The ripple effects of tariffs extend beyond manufacturers. For instance, Quartz reported that Signify, a parent company of Philips Hue, has announced price increases across its U.S. smart lighting lineup effective July 1, citing tariffs as the direct cause. Some Hue products are already about 10% more expensive in the U.S. than in Europe. Similarly, according to Reuters, an analysis of Amazon’s platform shows U.S. prices of Chinese-made goods rising 2.6% since January—climbing faster than general inflation. Most manufacturers are passing tariff costs to customers, making cross-industry price adjustments inevitable.

Beyond these primary methods, some companies are exploring alternative strategies. These include "shifting production," "moving manufacturing & supply sources to lower tariff countries," and "manufacturing location and product design changes." One respondent mentioned "reducing cost based on which duties are applied; reducing intercompany transactions; using built-up cost; tracking certificates of origin." Another highlighted, "Resourcing to alternate locations, and onshoring in some areas where feasible ROI."

Despite these efforts, large-scale reshoring and regional localization efforts are not yet widespread. While 31% are making significant diversification or domestic supply chain changes, the majority (59%) are primarily monitoring the situation with contingency plans rather than overhauling their networks. Others noted different approaches based on country origin and markets served, minimizing imports, and lobbying.

Still, while most companies continue to respond tactically, broader industrial trends suggest early signs of structural momentum in certain sectors. According to advocacy organization Coalition for a Prosperous America, tariffs—alongside targeted tax incentives—are helping to reduce U.S. reliance on China and driving renewed investment in domestic manufacturing. Sectors such as steel, appliances, EV batteries, semiconductors, and renewable energy equipment are seeing increased reshoring activity. While this resurgence is not yet widespread across all manufacturing, it marks a modest but meaningful shift: U.S. import volumes from China are declining. In a landscape where most firms are cautiously adapting, these developments highlight how some industries are beginning to turn short-term pressure into long-term repositioning.

Strategies to Reduce Tariff Impacts

Source: Manufacturers Alliance Mid-Year Tariff Impact Survey, June 2025

Sub-sector Differences Shape the Pace of Change

While many manufacturers are adjusting their inventory and sourcing strategies, the pace and intensity of these changes vary significantly by sub-sector. Industries most affected by tariffs, including fabricated metal products, machinery, and electrical equipment manufacturing, are leading the way in adopting more proactive approaches. These sub-sectors, which rely heavily on imported metals and components, are more likely to implement locked-in pricing, long-term stockpiling, and diversified sourcing arrangements.

In contrast, sub-sectors with more localized or less tariff-sensitive supply chains, such as chemicals or miscellaneous manufacturing, are reporting fewer adjustments. These companies often depend on stable domestic suppliers and have largely maintained existing inventory practices. Several respondents noted that supply availability has not been a concern, citing steady vendor relationships and limited exposure to tariff-impacted goods.

These differences reflect broader shifts in global supply chain strategy. As highlighted in "How Tariffs Are Reshaping Global Supply Chains in 2025", companies across sectors are accelerating near-shoring efforts and investing in technology to build more agile networks. According to Global Trade, manufacturers most exposed to tariffs are leading this transformation by prioritizing supplier diversification, regional sourcing, and the use of AI enabled visibility tools, which have emerged as top supply chain priorities for 2025.

Ultimately, these patterns underscore how exposure to trade risk is shaping strategy. Sectors under the greatest pressure are evolving more rapidly, while others remain in a monitoring posture. Across the board, manufacturers are reevaluating risk, building flexibility, and preparing for continued policy volatility.

Financial Strain Hits Margins and Markets

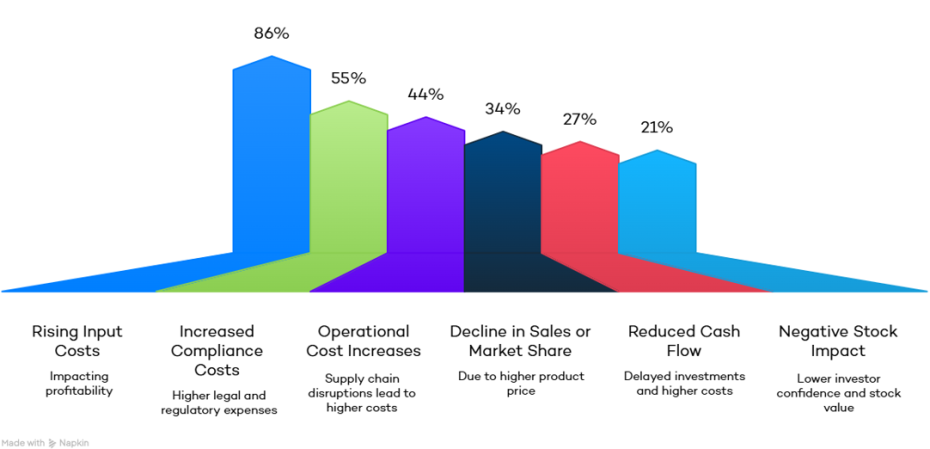

The most significant financial impact reported by manufacturers is rising input costs, cited by 86% of respondents, particularly for raw materials like steel and aluminum. Over half (55%) reported increased compliance and legal costs, while 44% cited operational cost increases due to supply chain disruptions. Additional pressures include:

- Decline in sales or market share (34%)

- Reduced cash flow or liquidity due to delayed investments or higher operating costs (27%)

- Negative impact on stock value or investor confidence (21%)

Financial Impacts on Manufacturers

Source: Manufacturers Alliance Mid-Year Tariff Impact Survey, June 2025

These reported pressures align with broader economic indicators. According to RTTNews, the U.S. manufacturing sector continued to contract in June 2025, with the Institute for Supply Management's manufacturing index inching up to 49.0 which is still below the threshold of 50 that indicates growth. While production improved slightly, the index showed a fifth consecutive monthly decline in new orders and a sixth straight month of falling employment, signaling that manufacturers remain in a defensive position. The data suggests ongoing caution in hiring and capital investment, consistent with the strategic hesitation and cost sensitivity reflected in our survey.

Despite these headwinds, some companies are identifying opportunities. One respondent noted “opportunities for margin expansion as a domestic supplier,” while another highlighted “more growth opportunity as manufacturers look to reshore.” These perspectives reflect a potential silver lining for companies able to reposition themselves as regional or lower-risk alternatives in an increasingly tariff-conscious marketplace.

Looking Ahead

A pervasive theme across all responses is uncertainty. Many comments highlighted the difficulty of planning amid rapidly shifting policies. One respondent lamented, "The uncertainty and constant changing of tariffs has caused a lot of disruption and extra work." Another expressed frustration over the "constant changes [that] make it difficult to consistently understand and manage the tariff impact." Yet, some see this as an opportunity for resilience and regional localization.

Despite enduring tariff concerns affecting competitiveness and costs, U.S. manufacturers are evolving through stronger mitigation efforts, supply chain diversification, and regional strategies to manage this ongoing new normal.